december child tax credit 1800

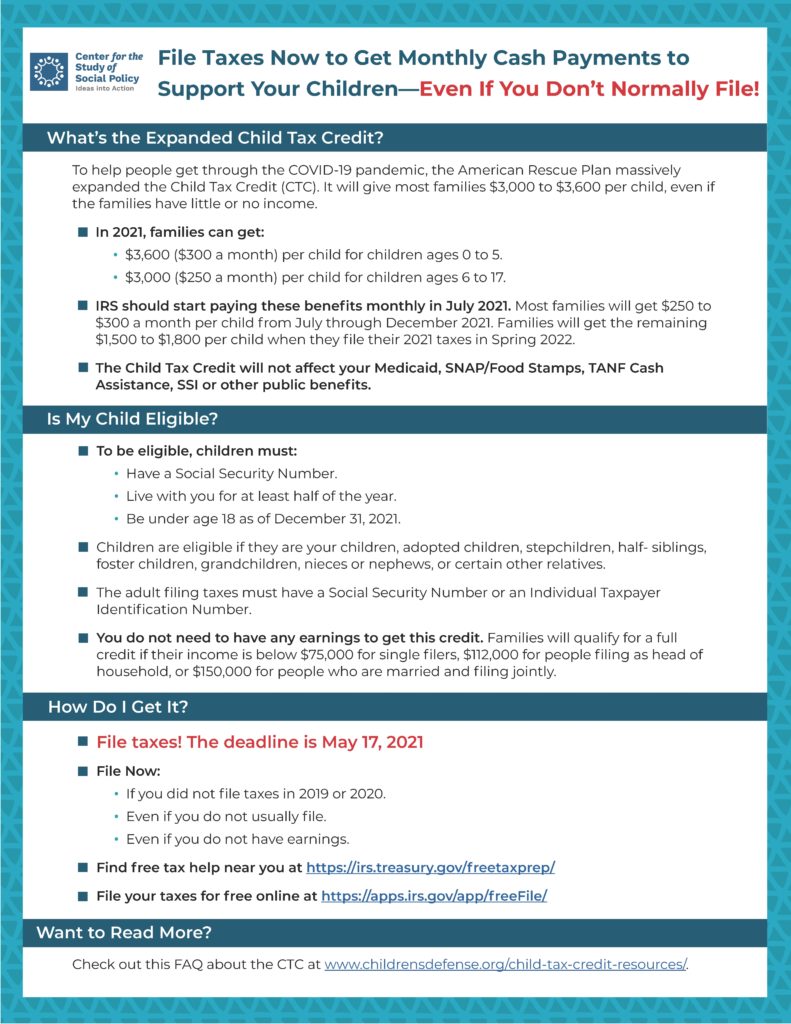

Families who sign up will normally receive half of their total Child Tax Credit on December 15. This assistance would be for parents who registered on the portal before November 15 who will receive up to 18000 per dependent.

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

What that means is that tens of thousands of households will receive a December.

. How much will I receive in 2022. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and. 1200 sent in April 2020.

Decembers stimulus check will be the final installment of monthly child tax credits but families can pocket up to 1800 when tax returns are filed next year. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. In July the IRS began sending advanced child.

Enhanced child tax credit. This means a payment of up to 1800 for each child under 6 and up to 1500. The remainder can be claimed when filing 2021 taxes in.

Families can expect their final child tax credit this month in just about two weeks. This means a payment of up to 1800 for each child under 6 and up to 1500. July that would mean.

AS the last batch of child tax credit payments for the year hits bank accounts in the middle of the month some families will get up to 1800 for. Enhanced child tax credit. Thousands of families will get an extra 1800 in Child Tax Credit money next month.

Parents can receive up to 1800 for every. Some families are expecting 1800 per child. That is the last scheduled day for child tax credit payments to go.

The amount you are paid in a lump sum this year depends on what you qualified for and received between July and December last year. How much money you could be getting from child tax credit and stimulus payments. Those who take advantage of it will get the full amount of all the payments up to 1800 per child Dec.

Up to 3600 per child or up to 1800 per child if you. Low-income families who signed up before the November 15 deadline will receive all the money they are owed in the December 15 payout according to the Internal Revenue. However the deadline to apply for the child tax credit payment passed on November.

Who is eligible for the 1800 Child Tax Credit payment. So for example if youre a non-filer with. The payment could be as much as 1800 for each child five years old or younger and up to 1500 for each child 6 to 17 years of age.

Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Families signing up now will normally receive half of their total Child Tax Credit on December 15.

While the monthly advance payments ended in December the tax season 2022 distribute the remaining Child Tax Credit money to eligible parents along with their 2021 tax.

How Does The New Child Tax Credit Work In Washington Here S What You Need To Know

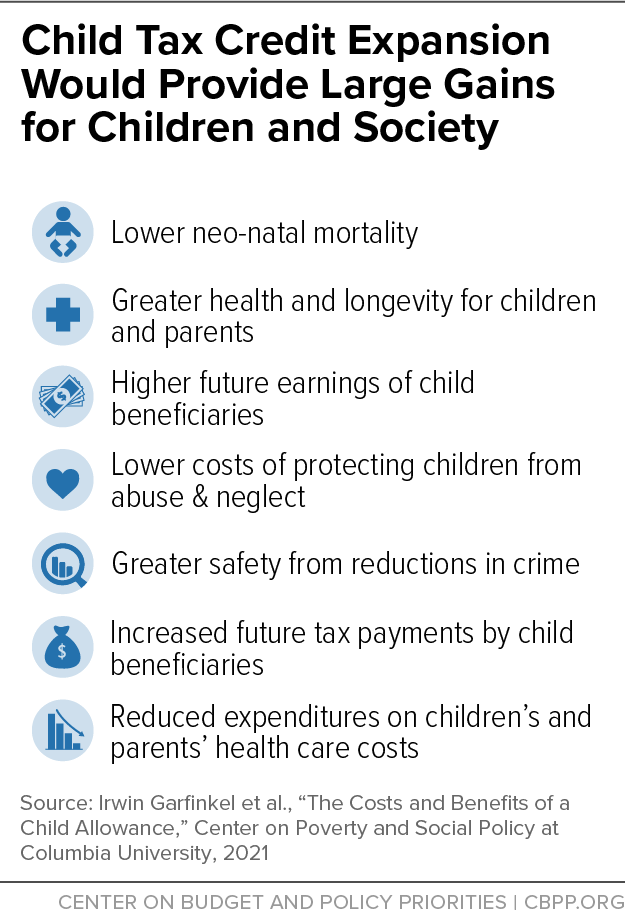

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

New Stimulus Payments Arrive This Week Some Families Will Get 1 800 Here S Why Wbff

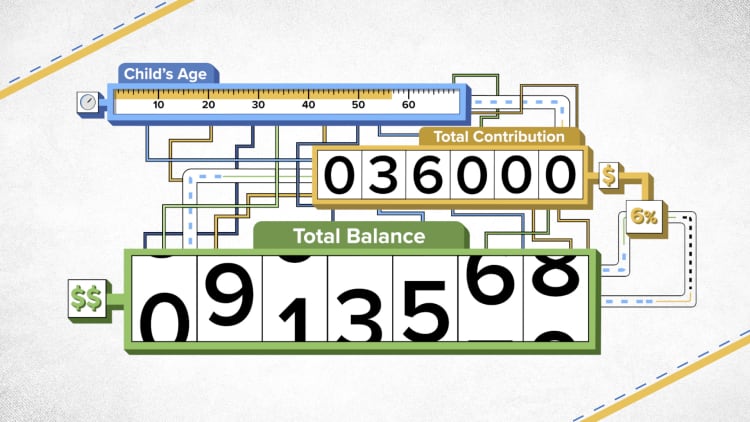

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Child Tax Credit Delayed How To Track Your November Payment Marca

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Stimulus Check Update These Families Could Get Up To 1 800 Per Child In December Wbff

About The Child Tax Credit Momsrising

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Child Tax Credit Payment Deadline Get Up To 1 800 Per Child If You Act Today Kiplinger

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Care Resources What S The Expanded Child Tax Credit

Child Tax Credit Payment July 8th Tiktok Search

Irs Expect Delay On Taxes If You Make Mistakes On Child Tax Credit

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs